Fedloan repayment calculator

As you might be aware federal student loan borrowers have access to multiple repayment plans. FedLoan Servicing has ended its contract with the US.

Thinking About Switching From Repaye While In Pslf Think Again Financial Rounds

This is your best option to keep payments manageable.

. You have a network of support to help you succeed with your federal student loan repayment. Adding those balances may extend the repayment term on your Direct Consolidation Loan as long as the total amount of the loans not being consolidated doesnt. IDR plans provide a lower monthly payment amount for borrowers who have high student loan debt relative to their income.

For student loan forgiveness. Is PSLF and an IDR plan right for me. 2 Investopedia Student Loan Debt.

As a result the repayment amount per month becomes more affordable than the amounts under other programs. If you have an ITT Tech Student Loan moving to an Income-driven repayment plan can also be a good idea. You have a network of support to help you succeed with your federal student loan repayment.

This 0 interest rate change applies to all ED-owned loans in any status in school in grace in repayment in defermentforbearance etc. The calculator does not guarantee that a particular outcome will occur. Your full account details should be available no later than 10 business days after the loan transfer date included in the transfer notification you received from your current servicer.

Department of Education and all current FedLoan borrowers will be transferred to new student loan servicers by the end of 2022. Federal Student Aid is committed to providing electronic and information technologies that are accessible to individuals with disabilities by meeting or exceeding the requirements of Section 508 of the Rehabilitation Act 29 USC. Income-driven repayment plans take income as a base.

IDR plans provide a lower monthly payment amount for borrowers who have high student loan debt relative to their income. Federal Student Aid FSA will begin transitioning the Public Service Loan Forgiveness PSLF program borrowers and their loans in stages from FedLoan Servicing to MOHELA starting in early July 2022 into September 2022. WARNING This system may contain government information which is restricted to authorized users ONLY.

FedLoan Servicing is a Servicer to Federal Student Aid. Department of Educations ability to service student loans owned by the federal governmentFedLoan Servicing is one of a limited number of organizations approved by the. 3 Experian Student Loan Debt Reaches Record High in 2020.

Submit a PSLF form to cover any gaps in your employment history especially for times when you worked in public service and were in repayment after October 1 2007. Is PSLF and an IDR plan right for me. This change in servicer will not impact the existing terms conditions interest rate or available repayment plans of your federal student loans.

In a matter of seconds receive an electronic document with a legally-binding signature. The deadline to submit a PSLF form with your full history of public service for the limited PSLF waiver is October 31 2022. 10000 IBR Loan with a 7 gross income payment percentage for a Senior student making 65000 annually throughout the life of the loan.

FedLoan Servicing is a Servicer to Federal Student Aid. Find out how Federal Student Aid partners with loan servicers to be here when you need help. One of the biggest disruptions is the transfer of federal student loan accounts that were previously held by FedLoan Servicing to the Missouri Higher Education Loan Authority MOHELA.

FedLoan Servicing is a Servicer to Federal Student Aid. Unauthorized access use misuse or modification of this computer system or of the data contained herein or in transit tofrom this system constitutes a violation of Title 18 United States Code Section 1030 and may subject the individual to civil and criminal penalties. PHEAA conducts its student loan servicing operations for federally-owned loans as FedLoan Servicing.

Therefore the signNow web application is a must-have for completing and signing income driven repayment idr plan request form 2022 pdf on the go. FedLoan Servicing was established by the Pennsylvania Higher Education Assistance Agency PHEAA and its more than 50 years of student aid experience to support the US. Actual results will vary.

Forgiveness through income-driven repayment. Loans from 5000 20000. Find out how Federal Student Aid partners with loan servicers to be here when you need help.

FedLoan Servicing is a Servicer to Federal Student Aid. Get income driven repayment idr plan request form 2022 signed right from your smartphone using these six tips. Grace Period Interest Savings Calculator.

Income-Based Repayment IBR Income-Contingent Repayment ICR If you do not know what repayment plan you are on for your Direct Loans visit StudentAidgov and find out. These adjustments became effective March 13 2020. Teacher Loan Forgiveness Quiz.

More flexible repayment options for struggling borrowers than other lenders. For PLUS loans that are in repayment have an active repayment schedule and have disbursements within 120 days the payments will automatically be applied as a normal borrower payment to interest and principal. You are not able to include private education loans in a Direct Consolidation Loan.

Income-Based Repayment IBR Income-Contingent Repayment ICR If you do not know what repayment plan you are on for your Direct Loans visit StudentAidgov and find out. Your monthly bill amount is set at a portion of your income and after 20 or 25 years your. All calculator results are based on information and assumptions provided by you.

Federal Student Aid. You could potentially qualify for forgiveness on your Direct Loans after 120 qualifying payments on an eligible repayment plan. Additional Considerations Private Education Loans.

Besides the remaining amount after the repayment period is forgiven. Grace Period Interest Savings Calculator. You have a network of support to help you succeed with your federal student loan repayment.

However those balances may be included in the debt not to be consolidated. Income-driven repayment plans are usually more affordable because the monthly amounts depend on the borrowers income level. FedLoan Servicing has automatically adjusted accounts so that interest doesnt accrue ie accumulate.

Find out how Federal Student Aid partners with loan servicers to be here when you need help. However only Income-driven repayment plans qualify for the PSLF. This loan transfer will not impact the existing terms conditions interest rates loan discharge or forgiveness programs or available.

FedLoan Servicing is a Servicer to Federal Student Aid. Teacher Loan Forgiveness.

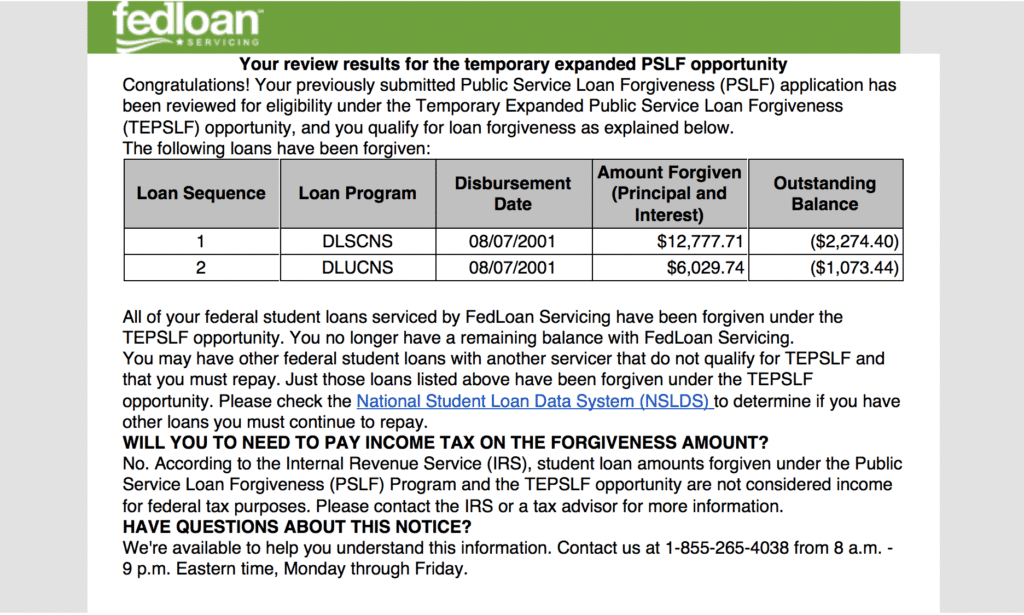

Tepslf Program Lessons From A Successful Applicant

Payments Billing Myfedloan

Student Loan Repayment To Resume But Few Know What They Owe Student Loan Hero

Student Loans Financial Education Program University Of Montana

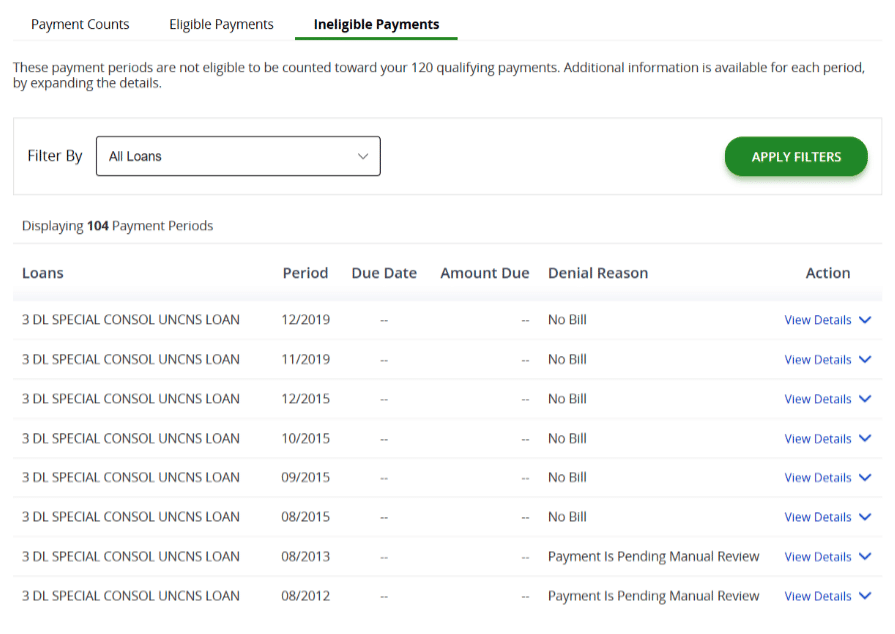

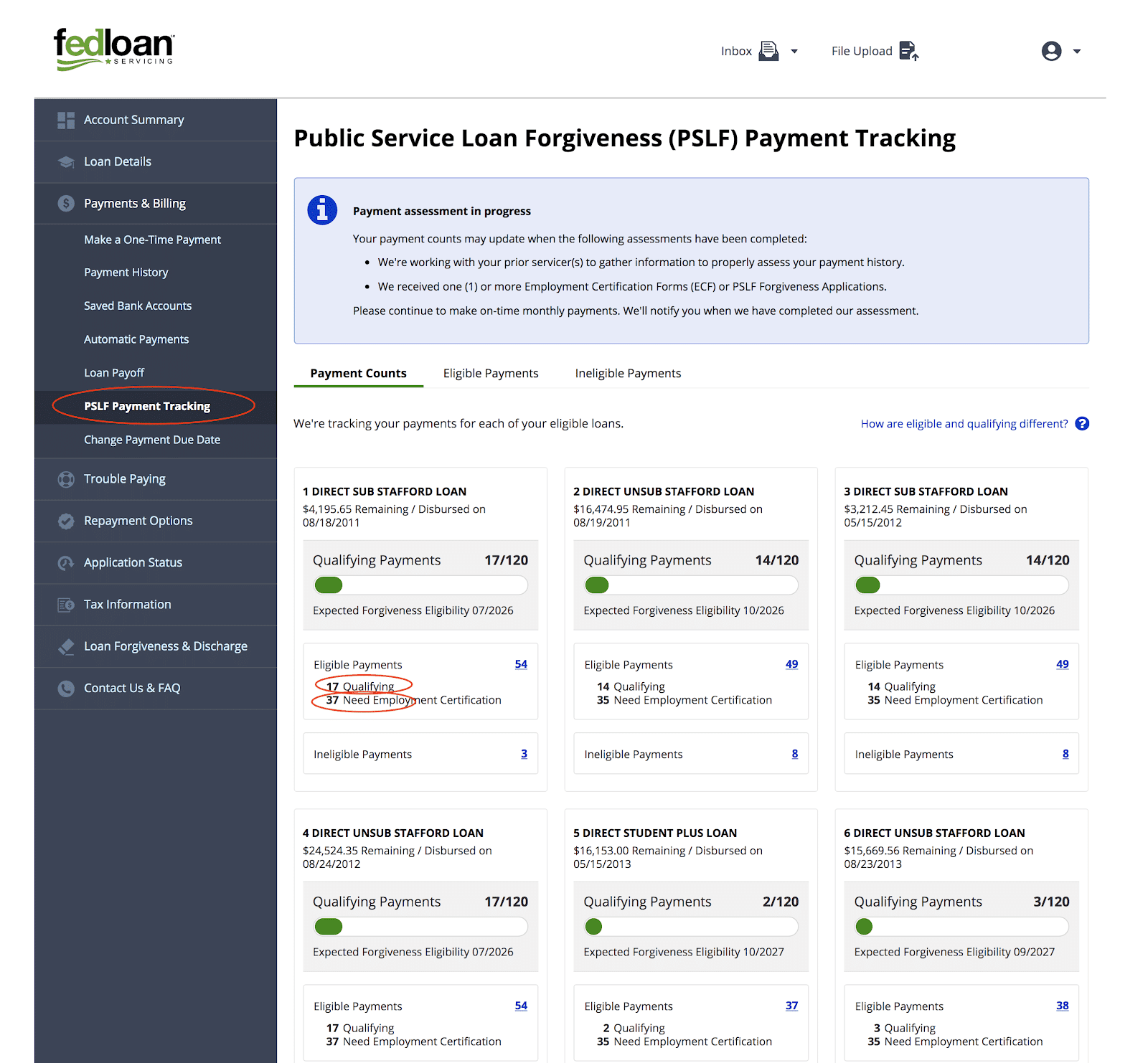

How To Track Qualifying Pslf Payments With Fedloan Student Loan Planner

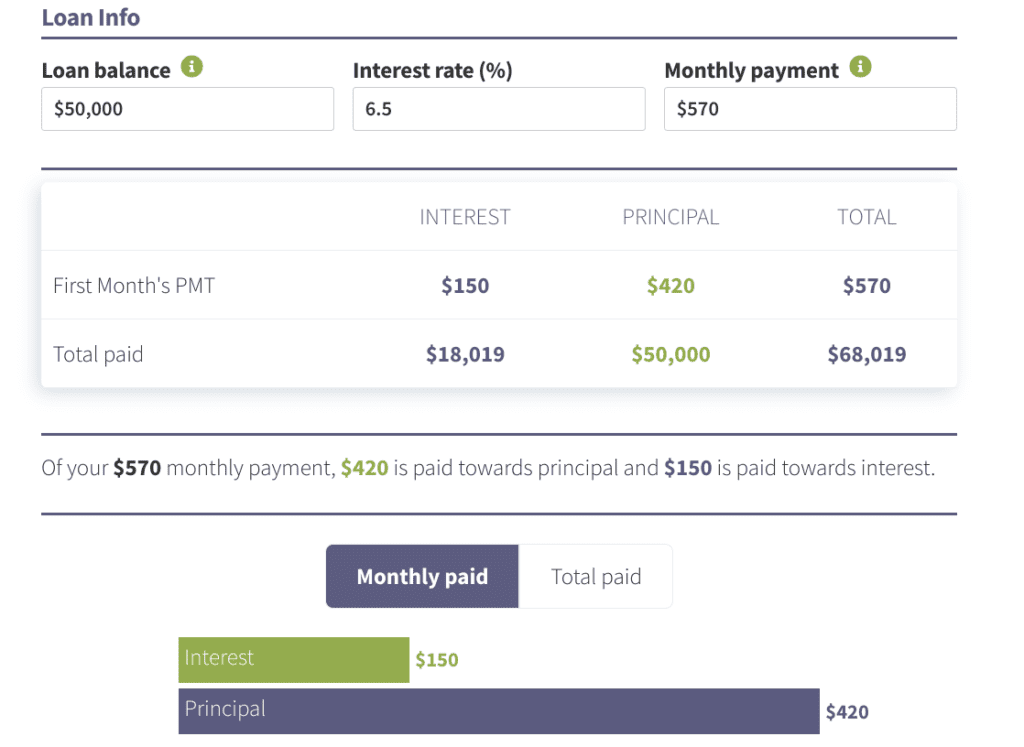

Student Loan Interest Calculator Student Loan Planner

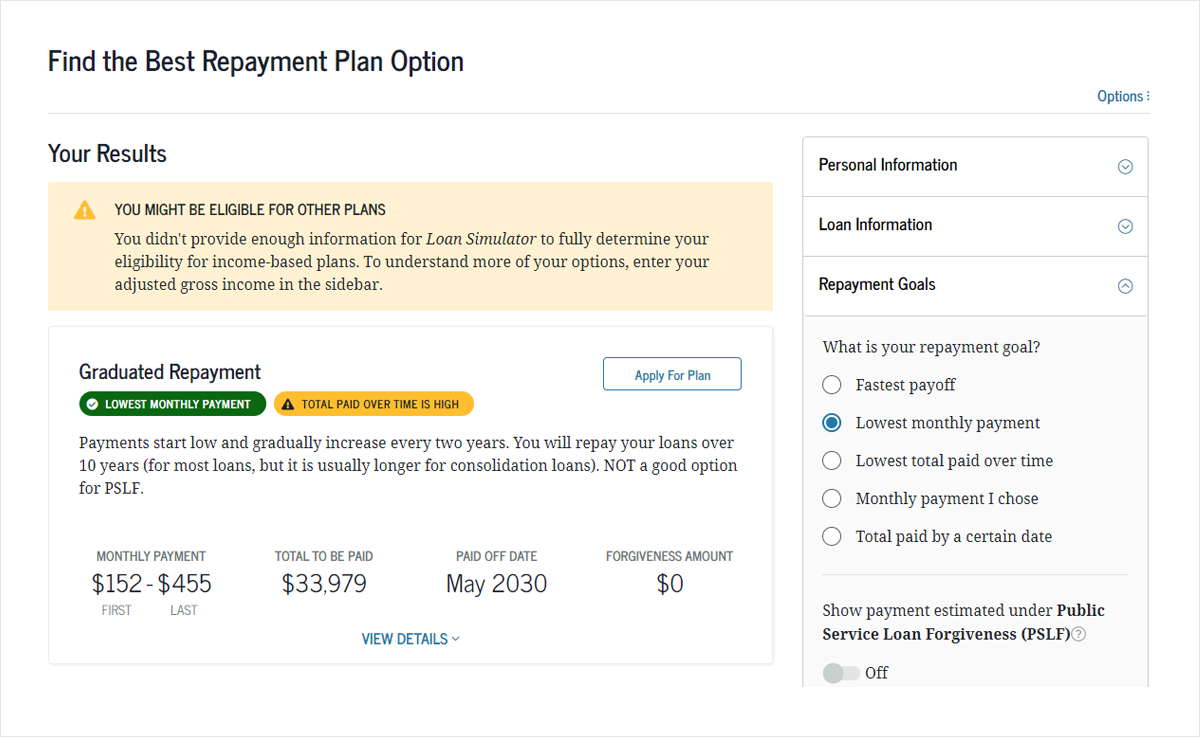

The Versatile Student Loan Calculator Loan Simulator Federal Student Aid

Student Loan Consolidation Calculator Simplify Your Loans Earnest

Fedloan Student Loans 4 5 0 Download Android Apk Aptoide

Payments Billing Myfedloan

Getting A Mortgage While On Income Based Repayment Ibr

Payments Billing Myfedloan

The Versatile Student Loan Calculator Loan Simulator Federal Student Aid

Student Loan Repayment Options Youtube

How To Track Qualifying Pslf Payments With Fedloan Student Loan Planner

Moonchild Consulting Home Facebook

Fedloan Servicing Review How They Manage Student Debt Lendedu